::::::::::Case Study::::::::::::

Opportunity A: Your bank is looking at an optical character recognition (OCR) system to further automate the check processing function. Check processing is a time sensitive function. If outgoing checks miss daily clearing deadlines, the bank looses use of the money for one day. Since your bank clears over one million checks per day, this can be a substantial amount. The current system, based on magnetic ink character recognition (MICR) is reliable, but labor intensive. It requires large numbers of relatively low-level employees to encode each check with magnetic ink. The cost of this process is very high and scheduling the right number of people to meet fluctuating volumes is challenging.

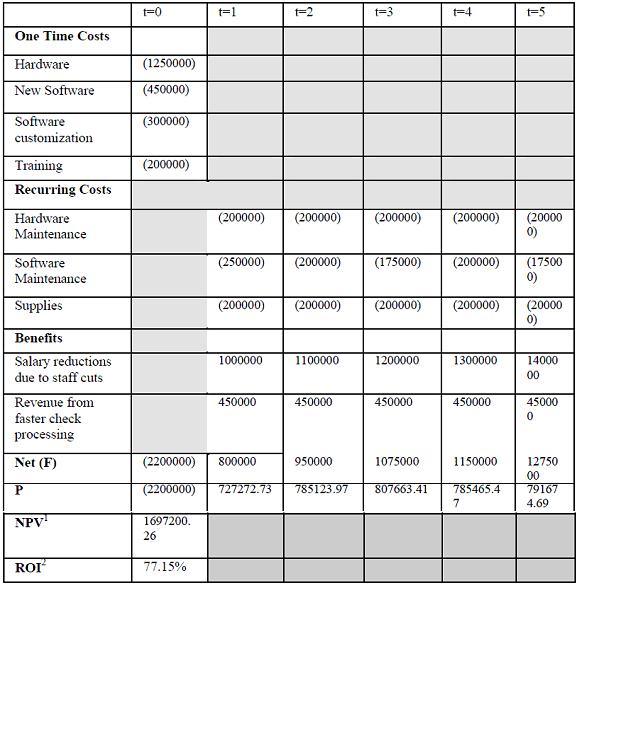

The initial investment for the OCR systems is estimated to be $1,250,000 for hardware, $450,000 for packaged software, $300,000 for customized modifications to the software, and $200,000 for training. Additional ongoing costs over a five (5) year system life are estimated to be: Hardware Maintenance: ($200,000 per year for 5 years); Software Maintenance: ($250,000; $200,000; $175,000; $200,000; $175,000); Supplies: ($200,000 per year for 5 years). Benefits over the five-year system life are estimated to be: Salary Reductions due to Staff Cuts: ($1,000,000; $1,100,000; $1,200,000; $1,300,000; $1,400,000); Increased Revenue Due to Faster Check Collection: ($450,000 per year for each of the 5 years).

Opportunity B: Your bank is looking at installing a new credit card processing system toreplace your aging mainframe system. Not only would the new system be less expensive to operate, but also there appears to be an opportunity to sell processing services to other banks that are looking to outsource this function. Your analysis of the credit card market suggests that there will be a continuing concentration in the industry as many small banks sell their portfolios to larger companies. You feel that a modern credit card processing system is essential if you are to compete effectively in this market.

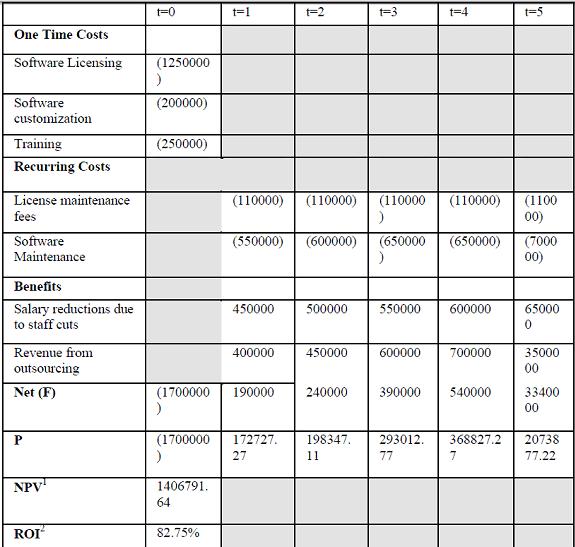

The initial investment for this credit card system is estimated to be: $1,250,000 for initial software licenses; $200,000 for customization of software; and $250,000 for training. Ongoing costs over a 5 year life are estimated to be: License maintenance fees: ($110,000 per year for 5 years) and Software maintenance: ($550,000; $600,000; $650,000; $650,000; $700,000). Benefits over the 5 year system life are estimated to be: Salary Reductions due to staff cuts: ($450,000; $500,000; $550,000; $600,000; $650,000) and New Revenues from Outsource customers: ($400,000, $450,000, $600,000, $700,000, $3,500,000).

Which alternative will you present to the IT Steering Committee and why?

::Analysis::

Under strict project constraints, we need to choose the best alternative between Option A and Option B. The current hurdle rate is 10%. Sections 1 and 2 details the cost benefit analysis matrix for option A and option B respectively. In section 3, we analyze the results and consider three major non-financial factors to finally arrive at the best alternative.

1 Cost Benefit Analysis :: Option A (Click to enlarge image)

2. Cost Benefit Analysis :: Option B (Click to enlarge image)

3. Justification for the right alternative

Looking at the ROI, option B seems to be appealing. But there is not much difference in the ROI of the two options and both exceeds the hurdle rate. Given such a scenario, we need to really take into consideration other factors such as project risks for each option, employee resistance and ability of each option to resolve current issues.

(a) Project Risk

Option B involves replacing the current mainframe based systems with the new system. The inherent risks involved in this whole process are gaining full management support for migrating systems from the well established and accepted mainframe systems, data migration issues and additional costs associated to data migration which is not counted in the assessment . Option A on the hand will not raise much risk as Option B as it is an addon feature to the existing system which is cumbersome and time-consuming. So, considering project risks, Option A is the best choice.

(b) Employee resistance

Both option A and B will introduce a certain amount of employee resistance to accept the new technology. Fear of losing jobs will be a major reason for resistance for Option A, mainly from the check processing staff. As the benefits assessment shows, there is expectation of huge saving from staff cuts. Option B also faces resistance, mainly from the IT department, in getting rid of the mainframe systems and thus, their competence in that area. Through appropriate training and awareness and employee involvement in the migration process, the resistance can be mitigated to a great extend. Option B seems to be favorable in this regard.

(c) Ability to solve current issues

The main reason for implementing option A is to reduce the huge time that is wasted in processing checks using the magnetic ink reading method. If company continues with the current technology, huge loss is predicted due to inability to clear daily checks. So, implementing Option A is of high priority, given the current situation, to realize huge gains in terms of faster processing of checks. Option B on the other hand, even though it brings in faster processing time and other benefits in terms of automatic credit card processing, it is not necessary to avoid any current financial loss.

Thus, considering the least project risk factors and the ability to resolve current issues which has great financial implications, Option A is the best alternative to work on.

nice blog! im following u..

ReplyDeletepls follow me back ;-)

I would like to share my secret how can i gain and increase followers & traffics to my blog within a week using a POWERFUL BLOG AUTO FOLLOW SYSTEM!!

I really liked your blog article.Looking forward for more such stuff.

ReplyDeleteI really liked your blog article.Looking forward for more such stuff.

ReplyDelete